Simple Calculation Mode

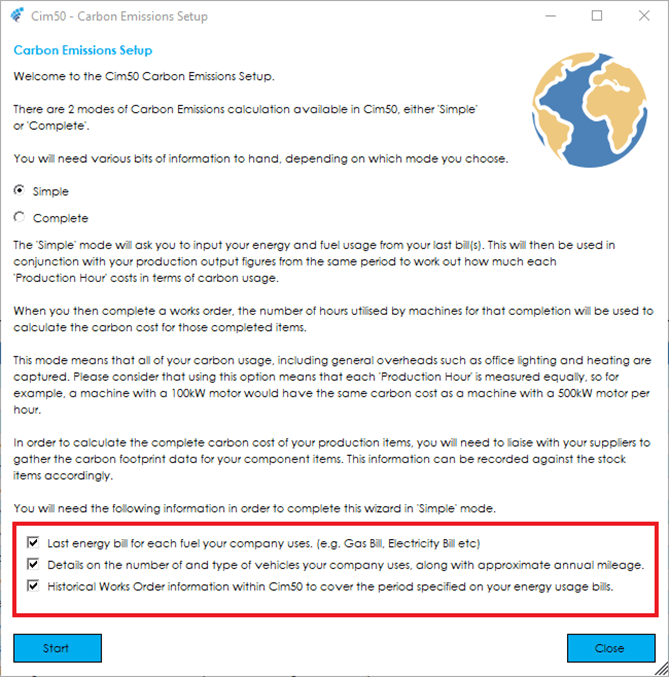

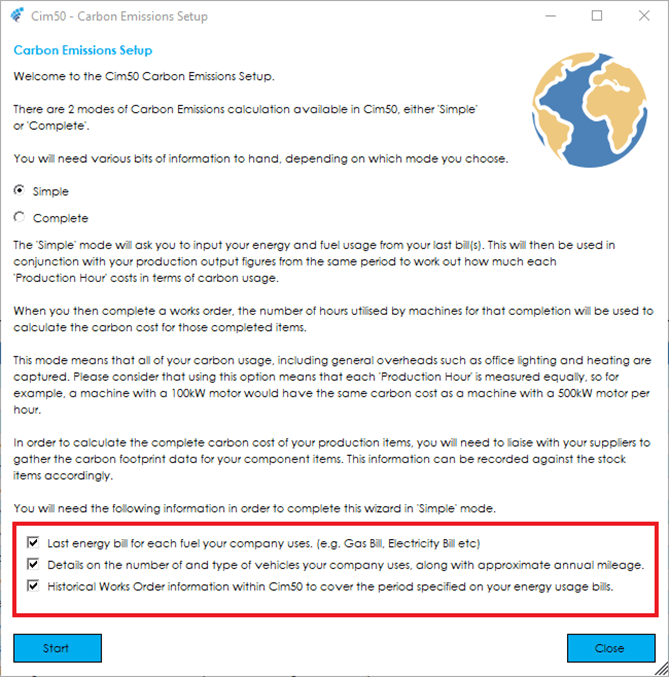

Simple mode requires less information from you but could result in less accurate results.

You will need to have available the last energy bills for each fuel that you use.

You will also need details on the number and type of vehicles you use, along with the approximate annual mileage for each vehicle.

Lastly, for the system to calculate an “hourly” carbon emissions figure that will be used by the system, some historical works order information is required within Cim50.

If you do not have this within your system you can manually enter these details.

You are required to confirm you have this information available to continue the setup process.

Step-By-Step Process

Press Start to begin the step-by-step process.

As you work through the setup process you will be asked to input details regarding various pre-defined fuels that your company may use. Fuels available in simple mode are:

- Electricity

- Gas

- LPG

- Fuel Oil

- Diesel (used in production environment, not in your vehicle fleet)

- Petrol (used in production environment, not in your vehicle fleet)

- Coal

- Wood Pellets

If a fuel you use is not available in the list of available fuels, you will need to switch the ‘Complete’ Carbon Cost mode.

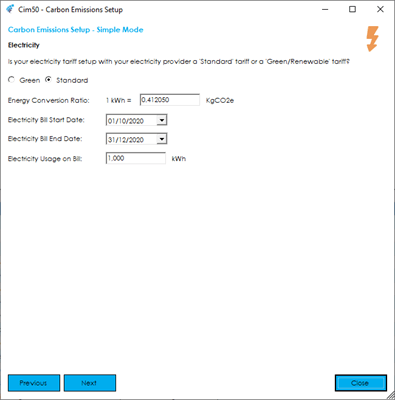

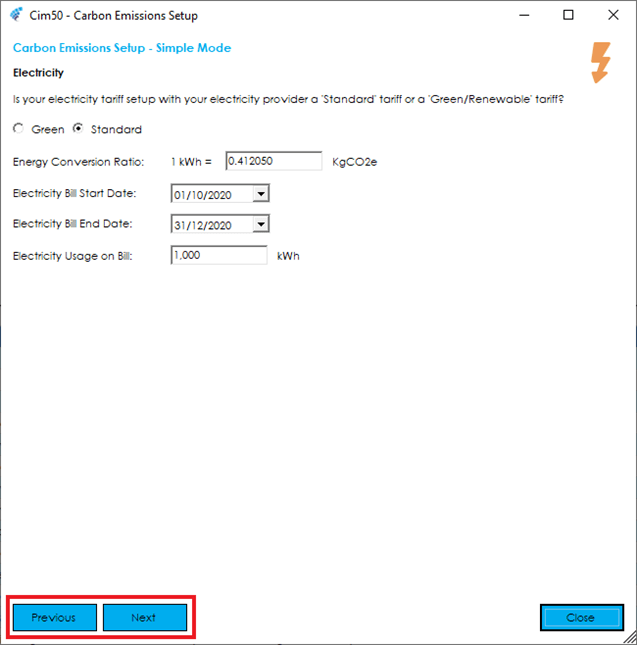

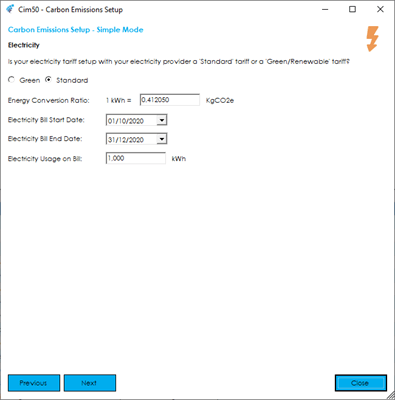

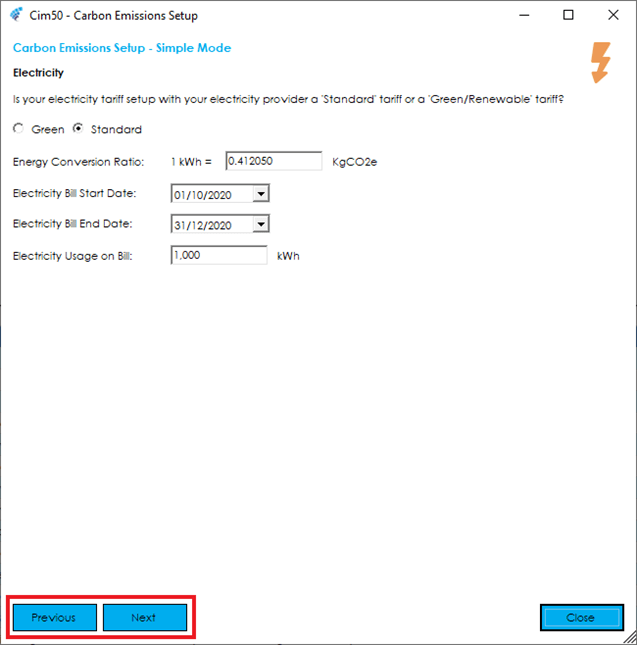

Details you will be required to enter are the Billing Start Date/End Date and the energy usage on the bill.

There are default energy conversion ratios for each fuel defaulted in the system which have been provided by The Carbon Trust, but you can override these if desired. Lastly, for each fuel type you will need to enter the usage quantity over the defined billing period.

Note: The Billing Start/End Date is only amendable for the electricity billing period, all other fuels are based on the electricity billing period. If you do not have corresponding bills for other fuels, you will need to calculate the equivalent usage over the defined electricity billing period from the bills you have available.

Press Next or Previous to proceed through each fuel available, or to go back and adjust a value on a previous fuel type.

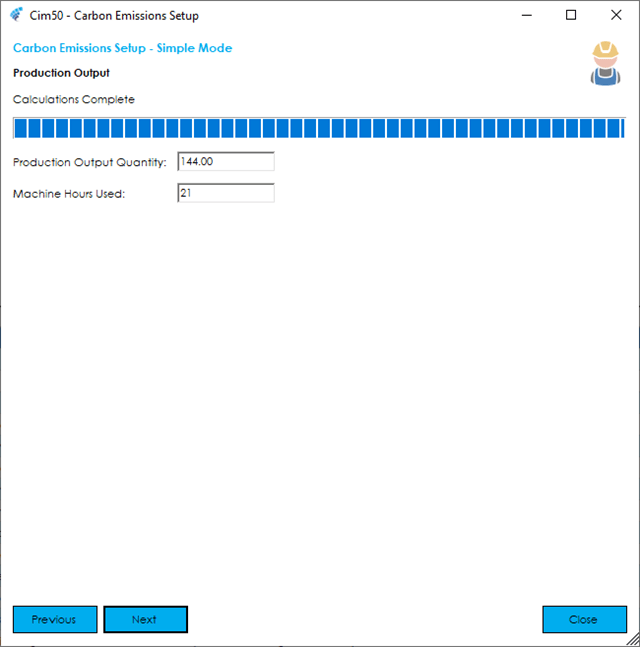

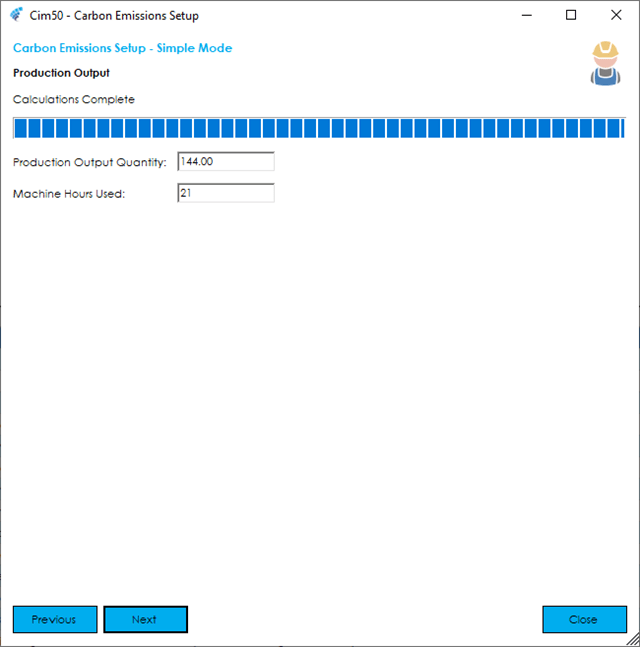

Once you have been through each fuel, the system will look back at your works order history over the defined billing period to calculate how many machine hours have been booked to works orders in that period, along with the production output quantity in that period.

These figures are used to work out the hourly Carbon Cost for the energy usage provided. If you do not have any history in Cim50, please estimate the total output quantity from works orders, along with the number of machine hours that went into those works orders over the billing period.

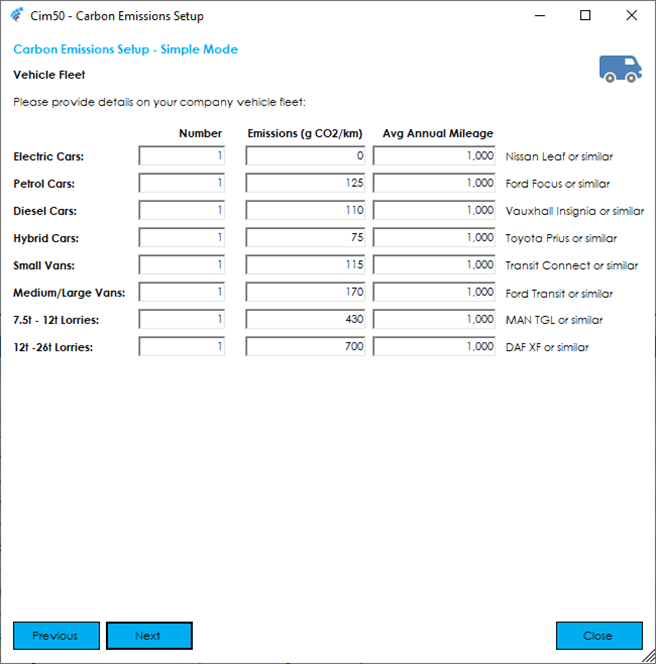

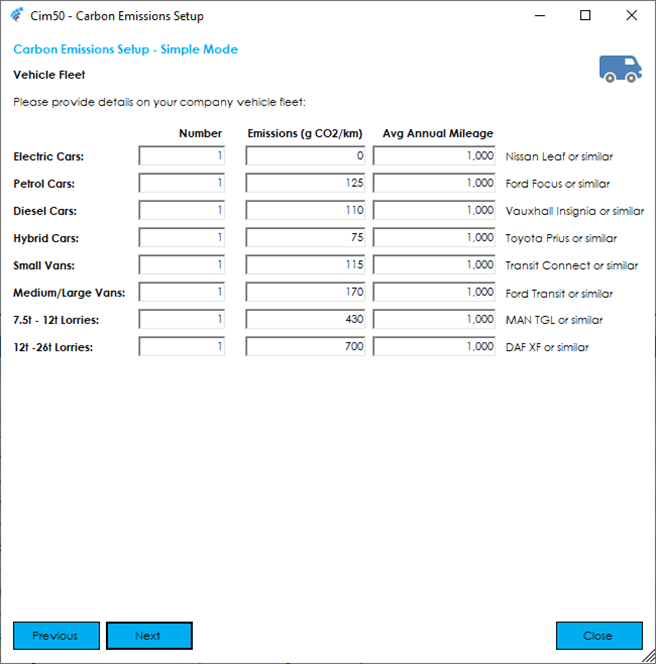

You will then be asked to confirm the number of vehicles you have in your company fleet.

There is a pre-defined number of categories available. If you have vehicles that do not fit into one of these categories, you will need to switch to ‘Complete’ Carbon Cost mode.

Enter the number of each type of vehicle, along with the average annual mileage for that category of vehicle.

The emissions data is based on grams of CO2 per kilometer (g CO2/km). The default values are based on an average vehicle of that type. You can adjust this accordingly to better suit the composition of your vehicle fleet.

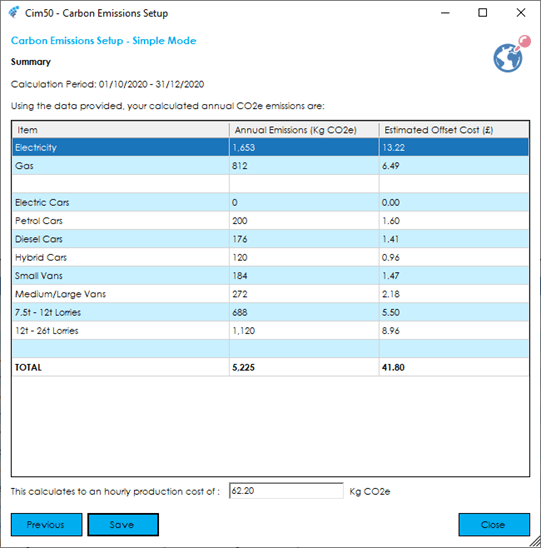

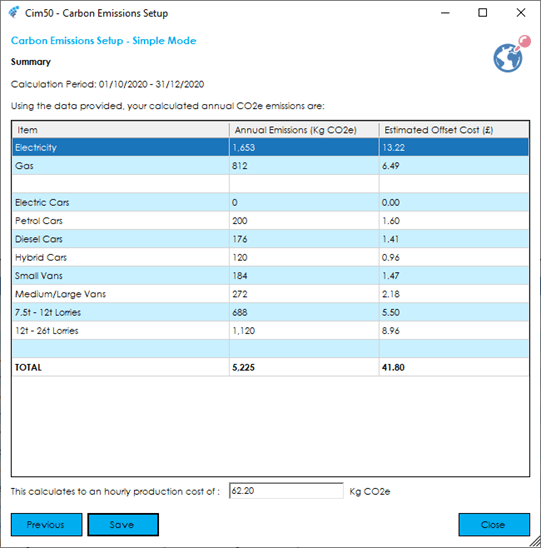

Finally, you will be presented with a summary of your estimated annual emissions for each fuel/vehicle specified, along with an estimated cost to offset.

It will also detail the calculated hourly production ‘Carbon Cost’ that will be used when calculating carbon emissions against Works Orders processed through the system going forward.

Calculations

Calculations used to calculate the hourly production cost are based on the following formulas.

Energy Usage:

[Annual Conversion Ratio] =

365 / Number of days in billing period.

This value is used to convert the usage over the billing period into an annual total.

[Energy Emissions] =

([Fuel Usage Amount] * [Fuel Conversion Ratio]) * [Annual Conversion Ratio]

This formula is applied against each fuel that has been defined as being used.

[Total Energy Emissions] =

SUM([Energy Emissions]) for each fuel.

The total energy emissions is calculated by adding each of the individual energy emissions together.

Vehicle Usage:

[Annual Vehicle Emissions] =

((([Annual Mileage] * [Number of Vehicles]) * 1.6) * [Emissions]) / 1000

This formula takes the vehicle mileage specified and multiplies it by the number of vehicles, then multiplies it by 1.6 to convert the miles specified into kilometres. That figure is then multiplied by the emissions specified and finally divided by 1000 to convert grams into kilograms.

[Total Annual Vehicle Emissions] =

SUM([Annual Vehicle Emissions]) for each vehicle category.

The total annual vehicle emissions are calculated by adding each of the individual annual vehicle emissions together.

Further Calculations:

[Total Annual Carbon Emissions] =

([Total Energy Emissions] + [Total Annual Vehicle Emissions])

The total annual emissions are calculated by adding the total energy emissions and total annual vehicle emissions together.

[Offset Cost Calculations] =

[Total Annual Carbon Emissions] * 0.008

The costs for offsetting carbon can vary from country to country and project to project. On average in the UK, it costs £8 to offset 1 tonne of CO2e, or just under 1p per kg.

[Energy Hourly Carbon Cost] =

[Total Energy Emissions] / ([Production Hours] * [Annual Conversion Ratio])

The hourly Carbon Cost for energy emissions is calculated by multiplying the production hours in the billing period by the annual conversion ratio. Then taking the total annual energy emissions, and dividing it by the result of that calculation.

[Vehicle Hourly Carbon Cost] =

(([Total Annual Vehicle Emissions] / 365) * [Days in billing period]) / ([Production Hours] * [Annual Conversion Ratio])

The hourly vehicle cost is calculated by dividing the annual vehicle emissions by 365, then multiplying the result of that calculation by the number of days in the billing period. The result is then divided by the production hours in the billing period, multiplied by the annual conversion ratio.

[Total Hourly Carbon Cost] =

[Energy Hourly Carbon Cost] + [Vehicle Hourly Carbon Cost]

This is the final value that is used by the system when calculating carbon cost on a Works Order.

See also

Related

Other tasks