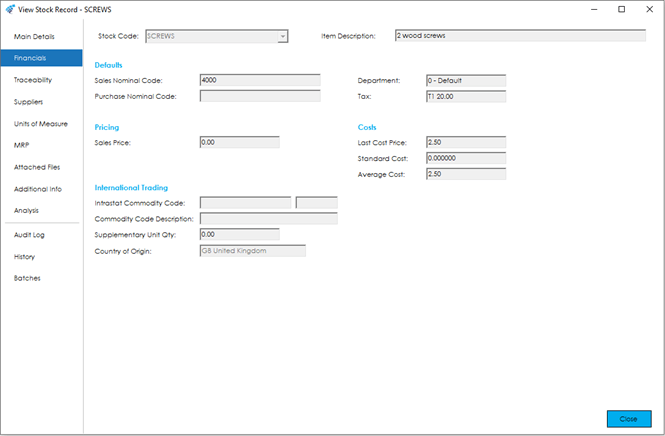

The Financials screen holds financial details and defaults relating to the Stock Record, the majority of which originate from the Product Record fields in Sage 50 Accounts.

The screen is broken down into the following sections and the fields within them are described below:

Defaults

These fields are all resident in Sage 50 Accounts and when creating a New Stock Record will default to the values set in Sage 50 Accounts via Settings> Product Defaults.

Sales Nominal Code: Choose the sales nominal code you want associated with the item when you create an invoice or order.

Note: New Nominal Codes can be setup in Sage 50 Accounts via the Nominal Codes Module.

Purchase Nominal Code: Choose the purchase nominal code you want associated with the item when you create a purchase order.

Note: New Nominal Codes can be setup in Sage 50 Accounts via the Nominal Codes Module.

Department: Choose a department between 0 and 999.

Note: New departments can be setup in Sage 50 Accounts via the Company > Department menu.

Tax Code: Choose the default VAT rate to apply to this item.

Note: New Tax Codes can be setup in Sage 50 Accounts via the Settings > Configuration menu.

Pricing

This holds the costs and sales prices associated with the Stock Record.

Note: The Decimal Places will default to the values set in Sage 50 Accounts via Settings> Product Defaults and is the case throughout the Cim50 solution.

Sales Price: Specify the default net sales price for this item.

Note: Any special customer pricing or discounts will need to be setup within the stock item in Sage 50 Accounts.

Last Cost Price: This is the last cost price for the item. This value is automatically updated each time a stock receipt is carried out.

Standard Cost Price: Specify a standard cost price for this item. Note – this is used for reporting purposes only.

Average Cost Price: This is a calculated value from the Sage 50 Accounts Database that is generally only available on reports in Sage 50 Accounts.

This is a calculation based on the current stock, for example we have a total of 20 in stock, 10 that cost £10 and 10 that cost £20, therefore the average cost price would be £15.

This value resets when a zero-stock balance is made positive, for example the 20 are issued, the company then receives a new batch of 10 at a cost of £17, the Average Cost price will be reset to this.

International Trading

Intrastat Commodity Code: Enter the items commodity code here.

For HMRC or Revenue to accept your Intrastat returns, this must be eight numeric characters. The final 2 characters are used for TARIC purposes when dealing with import duty.

Commodity Code Description: Enter a description for the commodity code here.

Supplementary Unit Qty: Enter any supplementary units here. For each commodity code, you must report either the net mass, or both the net mass and supplement unit quantities.

Country of Origin: The country where the item was manufactured.

Note: New Country Codes can be setup in Sage 50 Accounts via the Settings > Countries.